While looking for a vehicle, one of the most frequently asked questions is, Are newer cars cheaper to insure? Given their more safety functions and technical tendencies, it must come as no surprise that modern-day vehicles are much less pricey to insure. But the answer isn’t always clean. This text delves into the factors that determine insurance rates, gives examples, and answers often asked questions to help you make an informed decision.

Understanding Car Insurance Basics

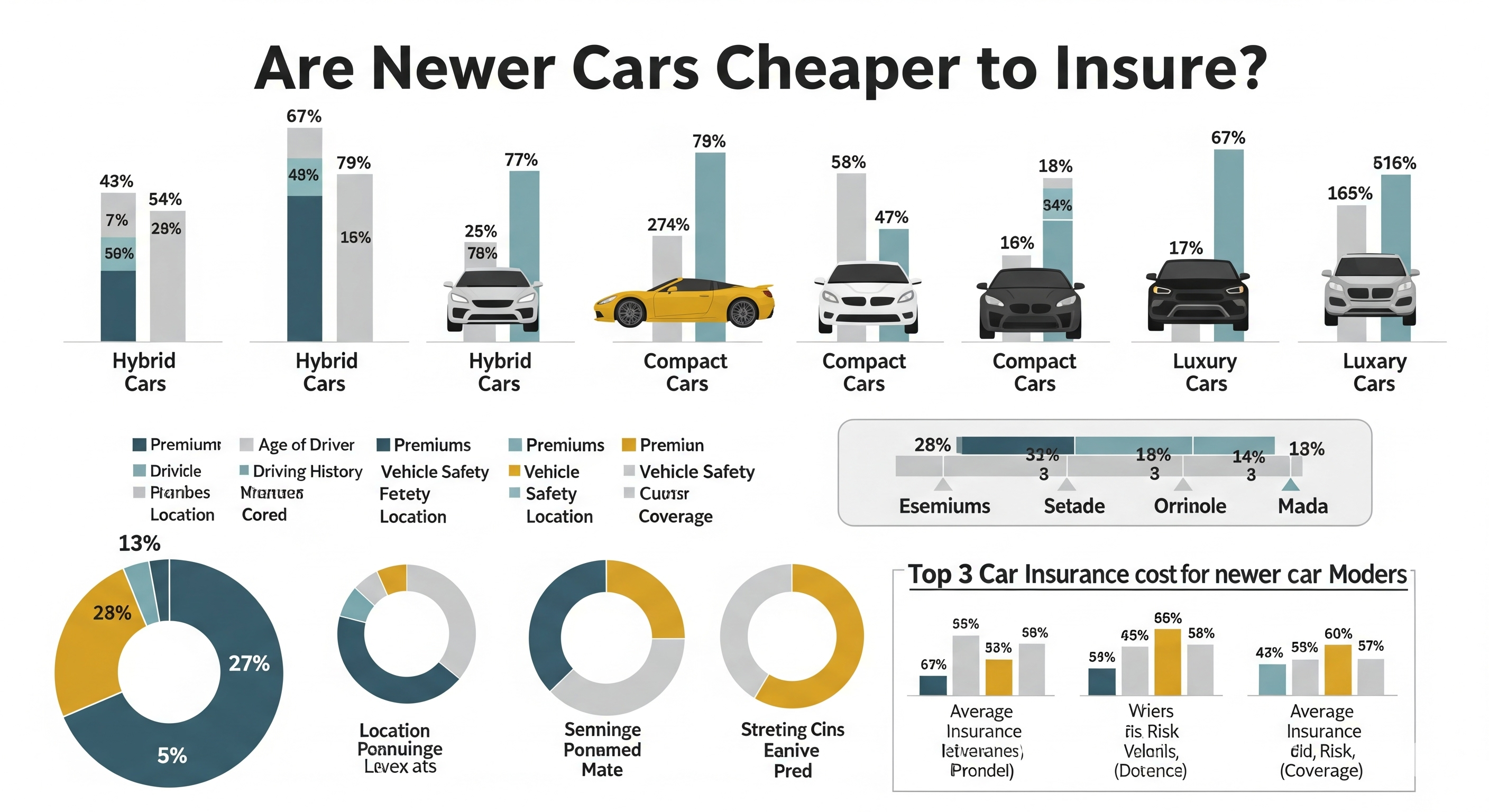

Answering the query: Are newer cars cheaper to insure? Apprehend the elements that determine vehicle coverage fees. Insurance agencies examine the hazard of the usage of a range of things, together with the driver’s age, region, riding records, and, most crucially, the auto itself. A brand-new vehicle might also have greater cutting-edge protection measures, but it’ll be more expensive to replace or repair.

The Role of Vehicle Value

One of the maximum crucial components to not forget, even when asking, Are newer cars cheaper to insure? Is the car well worth it? Normally, new cars cost more than older cars. If a more modern automobile is worried in a twist of fate and declared a complete loss, the coverage payment could be large due to the fact the car is more valuable. This can lead to better charges.

As an instance, a 2024 Toyota Camry might cost $28,000, whereas a 2015 Camry could cost $12,000. Coverage for more modern fashions is, in all likelihood, to be more steeply priced due to the increased value of alteration or repair.

Safety Features and Their Impact

Many people query, are newer cars cheaper to insure?. Because of the advanced protection capabilities. Lane-maintaining help, automatic emergency braking, and adaptive cruise management are all fashionable technologies in modern-day automobiles. Those characteristics can lessen the chance of injuries, leading to cheaper coverage prices.

But these equal technologies can be highly priced to keep. A fundamental bumper with sensors can cost masses or maybe heaps of dollars more than a regular bumper, canceling out any possible savings from reduced risk.

Theft Rates and Insurance

Some other elements to not forget whilst questioning are: are newer cars cheaper to insure? This represents the theft fee. New motors commonly incorporate innovative anti-robbery devices that can reduce the risk of theft whilst also decreasing coverage costs. However, famous models may additionally still be centered, and alternative additives can be more expensive, raising the total cost of insurance.

For instance, a brand new Honda Accord may be much less steeply priced to insure than an older model without a safety device, but if it is a popular target for robbery, the premium may be adjusted accordingly.

Repair Costs and Parts Availability

The provision and cost of alternative elements also factor into the query. Are newer cars cheaper to insure? More modern models might also include proprietary technologies or parts that aren’t presently available. If your automobile requires a new element, the insurance organization may additionally need to pay a premium for it, which is shown in your fee.

Components for older vehicles, on the other hand, are often more available without problems and much less expensive, resulting in lower repair prices and coverage charges.

Insurance Coverage Types

Whilst evaluating whether or not Are newer cars cheaper to insure? Keep in mind that new cars every now and then require comprehensive and collision insurance, especially if they may be financed or leased. These coverages protect your investment; however, they improve your top rate.

Older vehicles might not require as much insurance, particularly if their value is understated. In such instances, a driver may additionally pick liability-only effective coverage, which greatly reduces the fee.

Depreciation and Insurance

whilst addressing the question Are newer cars cheaper to insure? Depreciation is a crucial consideration. New automobiles depreciate speedily, losing value the moment they leave the dealership. While this could result in lower charges over time, the preliminary high price and multiplied coverage commonly outweigh the benefits of depreciation in the short term.

Coverage premiums may additionally drop through the years as the automobile depreciates, if the owner maintains a very good driving record.

Driver Discounts and Loyalty Programs

If you are nonetheless asking, are newer cars cheaper to insure? Take into account that many insurers offer discounts for bundling policies, being a loyal customer, or retaining an excellent driving record. These activities may additionally result in decreased insurance costs for new vehicles that have been insured with the same provider for some time.

Furthermore, more recent motors may be eligible for usage-based total coverage applications that rent telematics to monitor driving behavior. Those packages encourage appropriate driving behaviors, which may also bring about lower premiums.

Examples of Insurance Fee Comparisons

To further apprehend the problem, are newer cars cheaper to insure? Keep in mind the subsequent examples:

- 2023 Subaru Outback vs. 2015 Subaru Outback: The 2023 model has more safety features and a higher price. Coverage may cost a little, $1,400, in step with the year; however, the 2015 version might be towards $1,000.

- 2024 Tesla Model 3 vs. 2018 Tesla Model 3: Even though safety has stepped forward, the more modern model can be more pricey to insure due to higher-priced sensors and components.

- 2024 Ford F-150 vs. 2010 Ford F-150: even as the brand-new truck has higher protection capabilities, its high price and service costs normally result in higher rates.

Those examples display that, whilst protection improves, the whole cost and value of maintenance or alternatives often cause higher quotes.

Conclusion: Are Newer Cars Cheaper to Insure?

So, are newer cars cheaper to insure? Usually, no. Even as they offer extra protection and robbery prevention measures, their higher fee, great restoration prices, and the need for full insurance now and again weigh down these benefits. In case you qualify for reductions or take part in telematics applications, you may find that the distinction is much less sizable.

Finally, the quality approach is to accumulate prices for the unique vehicles you’re considering and evaluate them side by side by aspect. This permits you to make a knowledgeable decision primarily based on your budget and necessities.

Frequently Asked Questions (FAQs)

Q1: Are newer cars cheaper to insure than older vehicles?

Not usually. Whilst more modern automobiles have extra safety capabilities, their better value and maintenance costs often lead them to be more expensive to insure.

Q2: Can I lower my top class if I buy a brand new car?

Yes, if the new automobile has top protection ratings and anti-robbery features, you may be eligible for a reduction. However, the base premium is generally a whole lot better.

Q3: Are electric cars more expensive to insure than gasoline vehicles?

It relies upon. Electric-powered automobiles are generally more luxurious to maintain due to specialized components and labor; consequently, regardless of fewer moving components, they’ll now not be much less expensive to insure.

Q4: Does the sort of insurance have an effect? Are newer cars cheaper to insure?

Yes. New vehicles commonly require full coverage, which is more expensive. Older motors may also qualify for legal responsibility—the best insurance.

Q5: Is it ever financially better to insure a used car?

Sure. If the auto is cheaper and you can forego comprehensive and collision insurance, your rates could be greatly reduced.