If you personal a condominium, you’ve possibly wondered, Does condo insurance cover water damage? Water damage is one of the maximum not common and expensive problems condominium proprietors face, but many people aren’t entirely sure how their coverage policy works in these situations. This manual will break down how condo insurance commonly handles water damage, what’s covered, what’s not, and how to make sure you’re blanketed.

Understanding Condo Insurance

Before answering the question, Does condo insurance cover water damage, it’s important to understand what condominium coverage is. Condo insurance, also called an HO-6 policy, is designed to shield your private belongings, certain elements of your unit’s indoors, and your liability in case of accidents. It differs from homeowners’ coverage due to the fact that condo proprietors percentage duty for the building’s structure with other residents, and the apartment association generally has a separate master policy for the common areas.

The Short Answer: Does Condo Insurance Cover Water Damage?

In most instances, does condo insurance cover water damage? Sure, however, simplest under unique circumstances. Condominium coverage normally covers unexpected and unintended water harm, such as a burst pipe or a leaking water heater. However, it normally gained’t cover harm due to flooding, bad upkeep, or gradual put on and tear. The information relies upon your coverage, so usually study the best print.

Types of Water Damage Typically Covered

. While asking, Does condo insurance cover water damage, it’s crucial to recognize which types are usually covered. Maximum condominium insurance guidelines guard in opposition to:

- Burst pipes to your unit

- Overflow from home equipment like washing machines or dishwashers

- surprising leaks from water warmers

- unintentional water discharge from HVAC structures

- Water harm from extinguishing a hearth

As an instance, in case your upstairs neighbor’s tub overflows and leaks into your unit, your policy will probably coveryour damaged ceiling and private property — provided the reason was unintended and unexpected.

Types of Water Damage Usually Not Covered

To completely comprehendd does condo insurance covers water damage, you need to recognize what’s excluded. Not unusual exclusions encompass:

- Flood damage from heavy rain or rising water

- Water seepage via partitions through the years

- mold as a result of ongoing leaks

- harm from forgetting or loss of renovation

- Sewer backup (except you have introduced coverage)

As an instance, if you spot a small leak on your ceiling but ignore it for months, the ensuing mould and structural damage might not be covered due to the fact that the problem will be visible as preventable.

How the Condo Association’s Master Policy Fits In

While you consider does condo insurance coverss water damage, remember the fact that your condominium association’s master coverage also plays a role. The grasp policy generally covers the building’s shape, not unusual regions, and once in a while quantities of your unit, depending on whether or not it’s an “all-in” or “bare walls” coverage. Your HO-6 policy picks up where the grasp coverage leaves off, protecting your interior finishes and personal property.

As an example, if a water pipe bursts in the foyer and floods numerous first-floor devices, the master policy would possibly repair the building’s plumbing and drywall, while your rental coverage covers your floors and fixtures.

The Importance of Reviewing Your Coverage

In case you’re still uncertain approximately does apartment coverage cowl water damage, the best step is to review your coverage with your insurance provider. No longer are all guidelines equal, and insurance limits, deductibles, and exclusions can vary. Checking your insurance now can save you steeply-priced surprises later.

For example, you might find that your coverage covers $25,000 for private property but has a lower restriction for certain gadgets like electronics. If water ruins your $3,000 pc, you’ll need to understand whether you’re completely protected.

Examples of Water Damage Claims in Condos

To make the subject of does condo insurance covers water damage, right here are some real-life eventualities:

- Broken Washing system Hose – If the hose bursts and floods your laundry room, your policy will likely cover maintenance and replacement of damaged items.

- Neighbor’s Pipe Leak – If the unit above you has a plumbing problem that damages your ceiling and fixtures, your condominium coverage can assist with the maintenance.

- Slow Drip from Air Conditioner – If the drip causes damage over months, your claim is probably denied because it’s considered maintenance-associated.

Additional Coverage Options

Once in a while, the solution does rental coverage cocovers waters “not totally,” which is why you may need extra coverage. Riders or endorsements may be added to your coverage to defend against dangers like:

- Sewer Backup insurance – Protects against damage from backed-up drains.

- Flood coverage – Covers flood harm, which is excluded from traditional regulations.

- Mold Remediation coverage – helps pay for mold removal after water damage.

For example, in case you stay in a low-lying coastal region, adding flood coverage can save you lots in repair prices if a hurricane surge enters your unit.

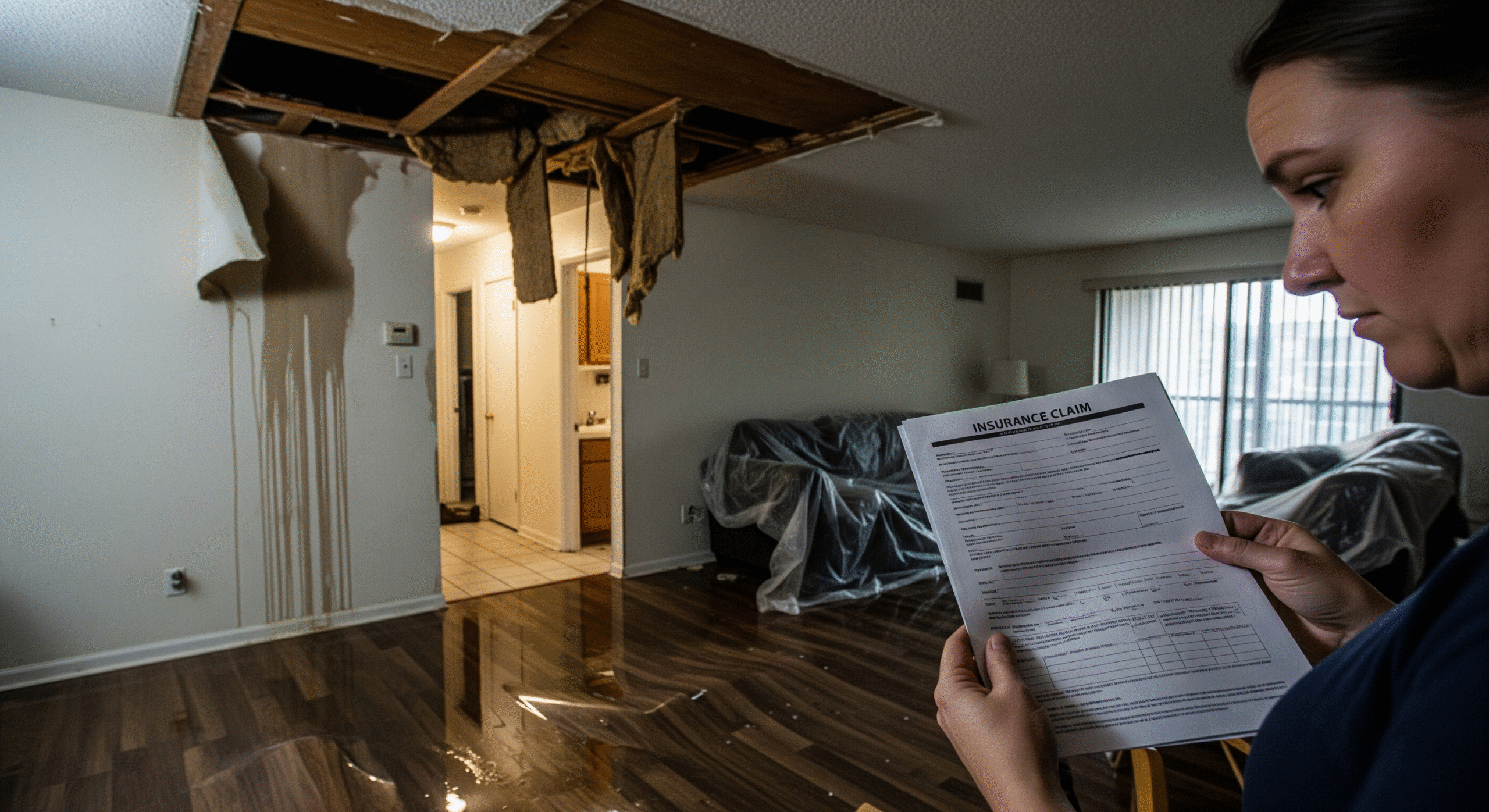

How to File a Water Damage Claim

Does condo insurance cover water damage? Additionally way knowing the way to make a claim effectively:

- Record the harm with pics and videos.

- Prevent the source of water if viable.

- Contact your insurance company right away.

- Maintain receipts for any temporary maintenance.

- Cooperate with the claims adjuster.

For instance, if a burst pipe floods your bedroom, taking clean snapshots before cleaning up can help show the extent of the damage to your insurer.

Steps to Prevent Water Damage.

Enough apartment insurance does not cover water damage; prevention is always better than filing a declare. Simple steps encompass:

- Regularly checking pipes and hoses for leaks

- Cleansing gutters to prevent water backup.

- Putting in water leak detectors.

- Shutting off the water supply while traveling.

As an instance, putting a leak sensor below your kitchen sink can warn you of a problem earlier than it becomes a major problem.

How Deductibles Affect Your Claim

Whilst comparing does condo insurance cover water damage, keep in mind that your deductible plays a big role. If your deductible is $1,000 and your declare is for $900, insurance won’t pay out. Deciding on a deductible that fits your price range and risk tolerance is essential.

For example, when you have a $2,500 deductible and minor water harm expenses $1,800 to restore, you’ll be paying out of pocket.

The Role of Liability Coverage

Liability coverage is some other factor of does apartment insurance covers water damage. In case your negligence causes water damage to another unit, your coverage’s legal responsibility portion may additionally cover maintenance to the affected unit and protect you from complaints.

As an example, in case you accidentally go away from your bathtub,ub going for a walk, and it overflows into your neighbor’s unit, liability insurance can help cover their restoration charges.

Common Myths About Condo Insurance and Water Damage

Many humans have misconceptions about does condo insurance covers water damage:

- Delusion 1: All water harm is protected — false. Handiest surprising, unintended harm is protected.

- Fantasy 2: The condo affiliation constantly pays — false. The grasp policy only covers positive regions.

- Myth 3: Flood harm is included — false. Flooding calls for separate insurance.

Understanding these myths can help you avoid steeply from steeply-priced misunderstandings.

Questions to Ask Your Insurance Provider

whilst clarifying does rental coverage cowl water damage, ask your insurer:

- What styles of water damage are blanketed or excluded?

- What is my coverage restriction for non-public assets?

- Does my coverage consist of sewer backup safety?

- How does my coverage work with the condominium affiliation’s master coverage?

For instance, you may find out that adding sewer backup coverage prices much less than $one hundred in line with year but could prevent lots.

State Laws and Regulations

The solution to does apartment insurance covers water damage also depends upon state legal guidelines. Some states require rental associations to hold broader master rules, even as others leave it to character proprietors to fill the gaps. Knowing your state’s rules permits you to make knowledgeable picks approximately your insurance.

How to Save on Condo Insurance

. Whilst exploring does condo insurance covers water damage, you would possibly additionally want to decrease your premium. Ways to store include:

- Bundling with vehicle coverage.

- Increasing your deductible.

- Installing protection devices like leak detectors.

- Maintaining a claims-free report.

For example, bundling your condominium and auto coverage with the same issuer can reduce your typical coverage price by means of 10–20%.

Real-Life Case Study

To demonstrate does condominium insurance cowl water damage, do not forget this case: A condo owner in Florida had a pipe burst in their kitchen while on vacation. The water broke the hardwood floors, shelves, and neighboring unit. Their HO-6 coverage blanketed their indoor maintenance and personal property, while the liability insurance treated the neighbor’s damages. Without this coverage, they could have faced over $30,000 in prices.

Conclusion

So, does condo insurance cover water damage? Sure, however, handiest under particular conditions. It usually covers sudden, unintended incidents like burst pipes or equipment leaks, but excludes sluggish leaks, flood damage, and forgetfulness. Expertise your coverage and supplement it with additional insurance if needed,, can guard you from economic complications.

FAQs About Does Condo Insurance Cover Water Damage

1. Does condo insurance cover water damage from flooding?

No, does condominium coverage cover water harm from flooding is a separate depend, you’ll need a separate flood coverage for that.

2. Does condo insurance cover water damage from a neighbor’s unit?

Yes, if the harm is surprising and unintended, does condo insurance cover water harm from a neighbor’s plumbing problem in most instances?

3. Does condo insurance cover water damage from water harm?

Sometimes. Does apartment coverage cover water damage that results in mould? Depends on whether the damage was unexpected or due to neglect.

4. Does condo insurance cover water damage from home equipment?

Sure, does rental coverage cover harm from home equipment like washing machines if it’s sudden and unintended?

5. Does condo insurance cover water damage in non-unusual areas?

Commonly, no. ‘’Does apartment coverage cover water damage’’ in common areas is a matter for the apartment affiliation’s master policy.

Read More: Does Car Insurance Cover Accidents on Private Property?