If you’re asking what is stacked uninsured motorist coverage, you’re already ahead of the curve about protecting yourself financially after a car accident. Even as many drivers recognise they want vehicle coverage, fewer recognize the additional layers of protection to be had especially with regards to uninsured or underinsured motorists. This article explains what is stacked uninsured motorist coverage, the way it works, who wishes it, and why it is probably really worth adding to your coverage.

Why Do You Need It? Real-World Risks Explained

One of the biggest motives to understand what is stacked uninsured motorist coverage is because of the startling range of uninsured drivers on the street. Consistent with the coverage studies Council, approximately 1 in 8 drivers within the U.S. has no insurance. This means there’s an actual chance you could be hit by someone who cannot pay for your medical payments or car damage.

If you’re questioning what is stacked uninsured motorist coverage exactly for in actual international situations, consider a situation where you’re involved in an extreme accident with a hit-and-run driver. If that motive force is in no way determined or seems not to don’t have any coverage ,you may be stuck paying out-of-pocket unless you have enough UM insurance. Stacking ensures you have got get entry to to a larger pool of price range to cover these fees.

What Is Stacked Uninsured Motorist Coverage?

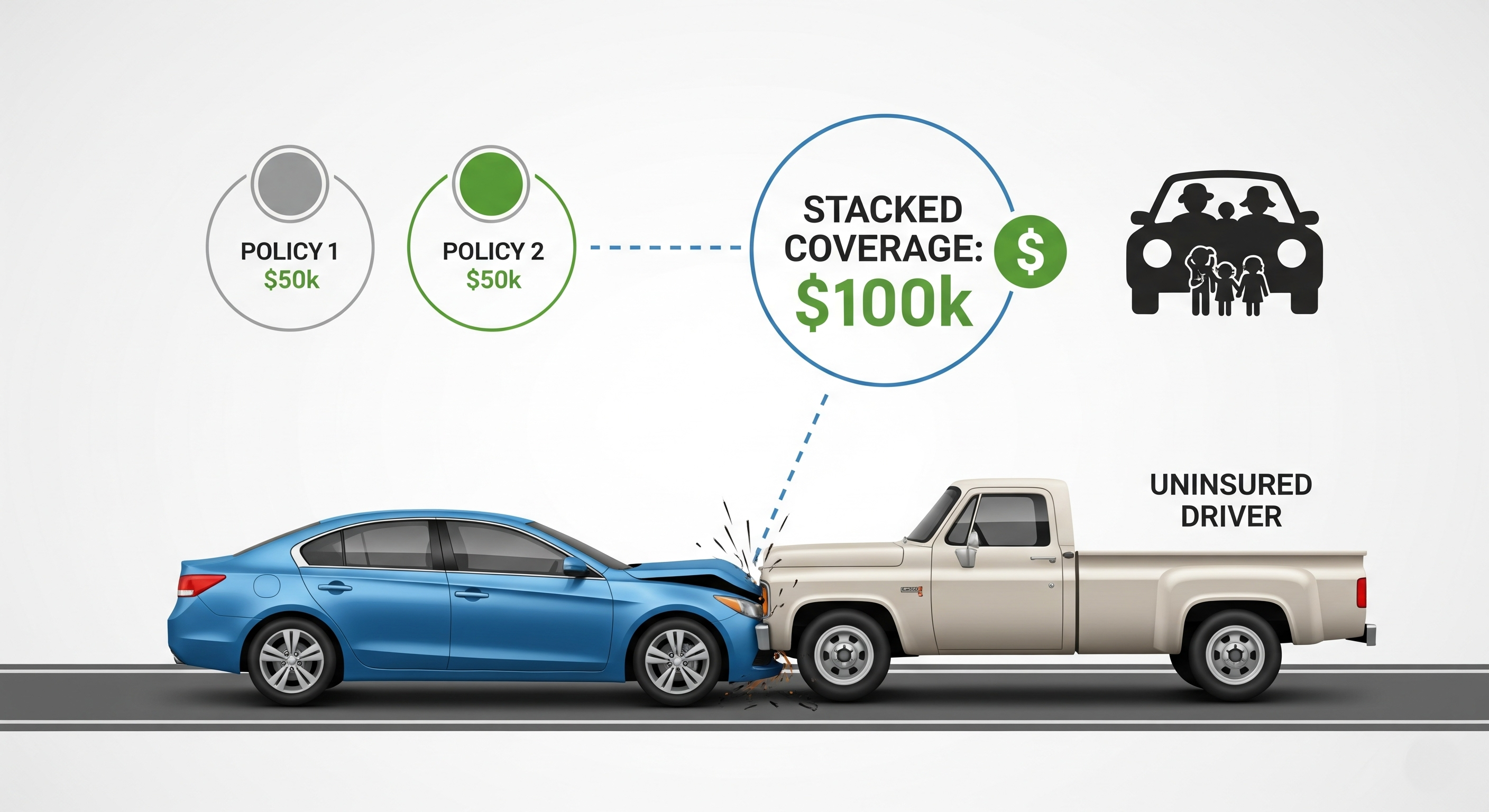

To answer the query, what is stacked uninsured motorist coverage, we need to first recognize what uninsured motorist (UM) coverage is. UM coverage protects you if you’re in an accident caused by a driver who doesn’t have coverage. But “stacked” coverage takes this a step further. It lets you mix or “stack” the uninsured motorist insurance limits of multiple automobiles for your policy, or across multiple than one guidelines, to growth your safety.

For instance, if you have motors in your coverage, each with $50,000 in UM insurance, stacking would provide you with a total of $100,000 in insurance in case you’re injured in an twist of fate as a result of an uninsured motorist. So what is stacked uninsured motorist coverage? It’s a way to multiply your safety by way of leveraging the coverage from a couple of insured vehicles.

Types of Stacking: Intra-Policy vs. Inter-Policy

As you explore what is stacked uninsured motorist coverage, it is important to understand the 2 primary varieties of stacking: intra-policy and inter-coverage.

- Intra-coverage stacking lets you stack coverage within a single coverage that covers more than one motor. For instance, in case your coverage covers three vehicles with $25,000 in UM insurance each, stacking could give you $75,000 overall coverage.

- Inter-policy stacking allows you to combine UM coverage from a couple of coverage policies. This is common for households in which distinctive members have separate guidelines but live in the same household.

So what is stacked uninsured motorist coverage in terms of policy shape? It’s a flexible device that may be tailored to fit a comprehensive coverage or several, depending on your household’s wishes.

How Stacking Differs From Non-Stacked Coverage

To better understand what is stacked uninsured motorist coverage, it allows us to contrast it with non-stacked coverage. Non-stacked UM insurance limits your declare to the insurance amount of a single automobile or coverage, regardless of what number of cars you insure. So if you have $50,000 in UM coverage, that’s all you get, even if you own 3 cars.

By using assessment, what is stacked uninsured motorist coverage presents you is extra robust safety. In preference to being locked right into a single payout restriction, stacking will increase the overall available finances, doubtlessly helping you get better absolutely from an accident.

Is Stacked UM Coverage Available in Every State?

Not all states allow stacking, so if you’re attempting to find what is stacked uninsured motorist coverage, you’ll need to check your state’s legal guidelines. A few states, like Pennsylvania, Georgia, and Florida, permit both intra-policy and inter-coverage stacking. Others may additionally allow simplest one kind, or none at all.

Whilst thinking about what uninsured motorist coverage is to your state, speak with your insurance agent or review your state’s branch of coverage insurance website. kKnowingyour nearby guidelines will let you make a knowledgeable decision approximately how much insurance you could legally stack.

Cost Considerations: Is It Worth It?

A major issue in figuring out what is the right uninsured motorist coverage for you is price. Stacked coverage usually will increase your top class, however, not by a great deal. In many cases, the cost brought is minimal compared to the gain of having appreciably more protection.

Stacked uninsured motorist insurance may cost a little simply $20–$50 according to vehicle every year well worth it in comparison to capability out-of-pocket expenses after a critical accident.

Who Should Get Stacked UM Coverage?

Another key consideration when evaluating what is stacked uninsured motorist coverage is whether it suits your particular scenario. You could gain from stacked coverage if:

- You personal multiple cars

- You’ve got a circle of relatives with several drivers and automobiles

- You live in a state with a high number of uninsured drivers

- You don’t have sufficient medical health insurance or want an additional layer of financial protection

For families with teenage drivers or folks who commute lengthy distances, know-how what is stacked uninsured motorist coverage may be the distinction among economic wreck and peace of mind.

Real-Life Example of How Stacked UM Works

To make it clearer what is stacked uninsured motorist coverage, let’s take a look at a actual-lifestyles instance.

- believe Jane owns two motors, each insured with $100,000 in uninsured motorist physical injury coverage. She’s hit via an uninsured motive force and suffers extreme accidents requiring $100 and $50,000 in medical care.

- With non-stacked insurance, she should most effective claim as much as $100,000 from one vehicle’s coverage.

- With stacked coverage, she will combine the $100,000 limits from both automobiles, giving her get admission to to $200,000 extra than enough to cover her costs.

So, what is stacked uninsured motorist coverage doing in this case? It’s remaining the monetary hole and supporting Jane avoid large out-of-pocket medical prices.

Are There Downsides to Stacked Coverage?

at the same time as expertise what is stacked uninsured motorist coverage in most cases reveals advantages, there are a few capacity downsides to be privy of.

- Slightly better charges: As cited in advance, you’ll pay extra for stacked insurance.

- Complexity in claims: In a few cases, stacking can cause extra complicated claims processing.

- Confined availability: not all states or coverage companies provide stacking.

Whilst asking what is stacked uninsured motorist insurance risks are, it is worth noting those exchange-offs, but for most people, the blessings far outweigh the cons.

How to Add Stacked Coverage to Your Policy

If you’ve determined that what is stacked uninsured motorist coverage aligns with your desires, the subsequent step is to talk to your insurance agent. They could verify whether stacking is criminal in your statend whether your modern insurerr supports it.

To encompass stacked insurance, you’ll normally want to:

- Choose-in explicitly whilst buying or renewing your policy

- Pay an additional premium

- Listing all cars or regulations to be protected in the stacking association

So, what is stacked uninsured motorist coverage requiring from you? Mainly, just a little proactive planning and communication together with your insurer.

(FAQs)

Q: What is stacked uninsured motorist coverage vs. underinsured motorist coverage?

While uninsured motorist (UM) covers accidents with drivers who’ve no coverage, underinsured motorist (UIM) insurance kicks in when the at-fault motive force has coverage, however, not enough to cover your damages. Stacking can apply to each UM and UIM coveragein some states.

Q: Is what is stacked uninsured motorist insurance necessary if I’ve medical health insurance?

Sure, due to the fact medical insurance won’t coverr things like lost wages, pain and suffering, or positive rehabilitation charges. What’s stacked uninsured motorist coverage supplies a broader financial safety net than just scientific insurance.

Q: Am I able to stack insurance across special insurance agencies?

In all likelihood, if inter-policy stacking is allowed for your nation and you have a couple of regulations below exceptional companies. But that is less unusual and can require unique approval. So while studying what is stacked uninsured motorist coverage, check the the policy information carefully.

Q: How do I know if my policy is stacked?

Your policy declarations page will generally suggest whether or not you’ve opted for stacked or non-stacked coverage. If in doubt, ask your coverage agent without delay: “What is stacked uninsured motorist coverage on my contemporary plan?”

Conclusion

know-how what is stacked uninsured motorist coverage helps you make smarter, extra defensive picks for yourself and your circle of relatives. It gives an effective way to enhance your financial safety without a prime premium increase. Whether you are a multi-car household, a common motive force, or simply someone who desires complete protection, stacked UM insurance is probably the safety net you didn’t understand you wanted.

Constantly discuss with a certified coverage expert to ensure your insurance meets your precise desires. Now that you recognize what uninsured motorist insurance is, you’re in a better position to pick out the right vehicle insurance alternatives for your way of life.

Read More: Does Car Insurance Cover Flooding?